Recently, I’ve been hearing a lot of questions when it comes to hiring groomers and stylists. Questions like, “How should I grow my business? Which is better – independent contractors or employees?”

Early in my career I faced the same question. I went the same route as many of you. I was phenomenally successful with my first mobile grooming van in the early 80s. I needed to bring someone on to help handle my client load.

At the time, it was just me. I wore all the hats. My focus was strictly on grooming and growing my business. I didn’t have time to deal with payroll, taxes, and Workman’s Comp. The easiest way for me to handle the situation was to bring on an independent contractor to run a second van. Within a very short time I needed to bring on another van with another independent contractor.

At the time, it was just me. I wore all the hats. My focus was strictly on grooming and growing my business. I didn’t have time to deal with payroll, taxes, and Workman’s Comp. The easiest way for me to handle the situation was to bring on an independent contractor to run a second van. Within a very short time I needed to bring on another van with another independent contractor.

As I was growing the business, my father (who is also a successful businessman) was watching over my shoulder. He heavily questioned my thought process about using independent contractors instead of employees. Just like many of you, I had every excuse in the book as to why independents contractors were better for my business.

- “I can’t afford employees.”

- “I don’t have time to figure out all the taxes.”

- “They supply all their own hand tools.”

- “They work without supervision in the vans.”

- “Everybody else pays their groomers as independent contractors.”

I was confident I was doing the right thing.

Was I?

I ran like this for a number of years. My business was growing and so was my team. Then I learned about one of my idols who was a very knowledgeable and talented pet stylist who bought an existing and thriving salon.

The IRS had come in for a standard audit of his business. Guess what? They determined all of his independent contractors were actually employees. They went after him for all of the back taxes for the entire team. Years of back taxes. And to make matters even worse – they went after him for all of the back taxes due from the previous owner, as well.

My idol was destroyed – not just financially.

He lost his business.

He lost his house.

He lost his marriage.

He lost everything. He virtually became homeless.

Once I learned of this story, I went back and really looked at how I was running my business.

- The company dispatcher booked our contracted stylist’s appointments.

- The company dictated what their route needed to be and what time they needed to arrive to the client’s home.

- The contracted employees were required to create daily written records of the services provided along with the charges with each appointment. With existing clients, stylists were expected to follow the directions in the trim histories, plus they were required to abide by the established pricing structure.

- Checks were made out to my company.

- The company set the pricing structure charged for the work done by each stylist.

- The contracted employees worked full-time for my company.

- The contracted employees were paid weekly commissions based off of their previous week’s sales.

- I supplied the van, the tables, dryers, shampoos, vacuums, maintenance on the vans, fuel, and auto insurance on the mobile units.

- All vans were stored and dispatched out of my property.

- I had the ability to fire them.

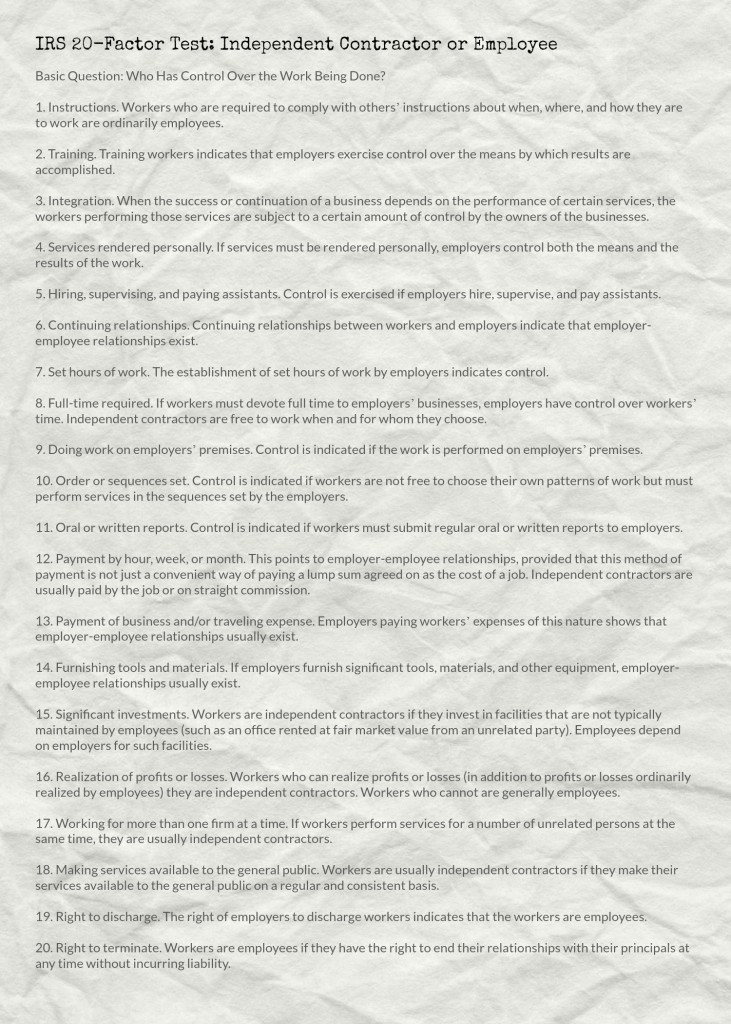

Sure, there are a few gray areas. When I reviewed the list of 20 questions the IRS (see the image below) uses to determine whether a team member should be receiving a 1099 or a W-2, I had that deep gut sense I had been working with misclassified workers. I was terrified.

I flipped my team of independent contractors to employees almost instantly and never looked back. My father was immensely relieved with my change of heart – and rightly so.

Yes, having employees was more costly to my business. I made the necessary adjustments. I raised our grooming prices. I hired an office assistant to deal with the weekly payroll. I boosted the level of responsibility of my accountant to deal with taxes on a quarterly basis. We made it work and we continued to thrive.

Yes, having employees was more costly to my business. I made the necessary adjustments. I raised our grooming prices. I hired an office assistant to deal with the weekly payroll. I boosted the level of responsibility of my accountant to deal with taxes on a quarterly basis. We made it work and we continued to thrive.

If you are in the United States, take a look at the questions below. You can click on and print the image to review it more carefully. Answer them honestly. What is your gut telling you?

This is not an area where you can afford to be wrong. Choosing the wrong classification could cost you weeks – if not months – of grief. Maybe you’ll get away with a slap on the wrist. Maybe you’ll have to make up all those back taxes and pay them to the IRS. Or maybe they will come down so strongly you could lose your business. Your home. And even your life as you know it.

Are you willing to take the risk?

Are you in this situation? Jump over to the Learn2GroomDogs Facebook page and tell us about it!

Happy Trimming!

~ Melissa